Throughout the life cycle of a business, ownership’s goals change on both an individual and company-wide level. After dedicating themselves to their business for some time, owners often look for an exit strategy that benefits them and ensures their business's future success.

If the existing management team wants to stay involved in day-to-day operations and has the desire to pursue additional growth and profitability, a Management Buyout (“MBO”) can act as a powerful transitionary tool for owners, capitalizing off the work they’ve put into the business, while providing an exciting path to ownership for the company’s management team.

If you’re a business owner considering a management buyout, this article will help you gauge whether it is the correct choice for your business. If you’re a manager of a business you are hoping to acquire, this article will outline key considerations in a management buyout.

Management Buyout Overview

In its most basic form, a management buyout involves an owner attempting to sell their company to their management team or a management team approaching an owner to gain majority equity interest in a business.

The underlying motivation for both parties involved in the buyout is to generate value. Ownership wants to find a lucrative exit strategy, while management hopes to secure a stake in a valuable business with a platform for growth.

In a traditional management buyout, a company's management team acquires the company's equity from the existing owner. There are many forms of a management buyout that we will cover below.

Management buyouts require the alignment of several different and sometimes competing interests to reach a common goal. This can turn into a complex process but setting honest expectations and keeping communication transparent can lead to a smooth and efficient process.

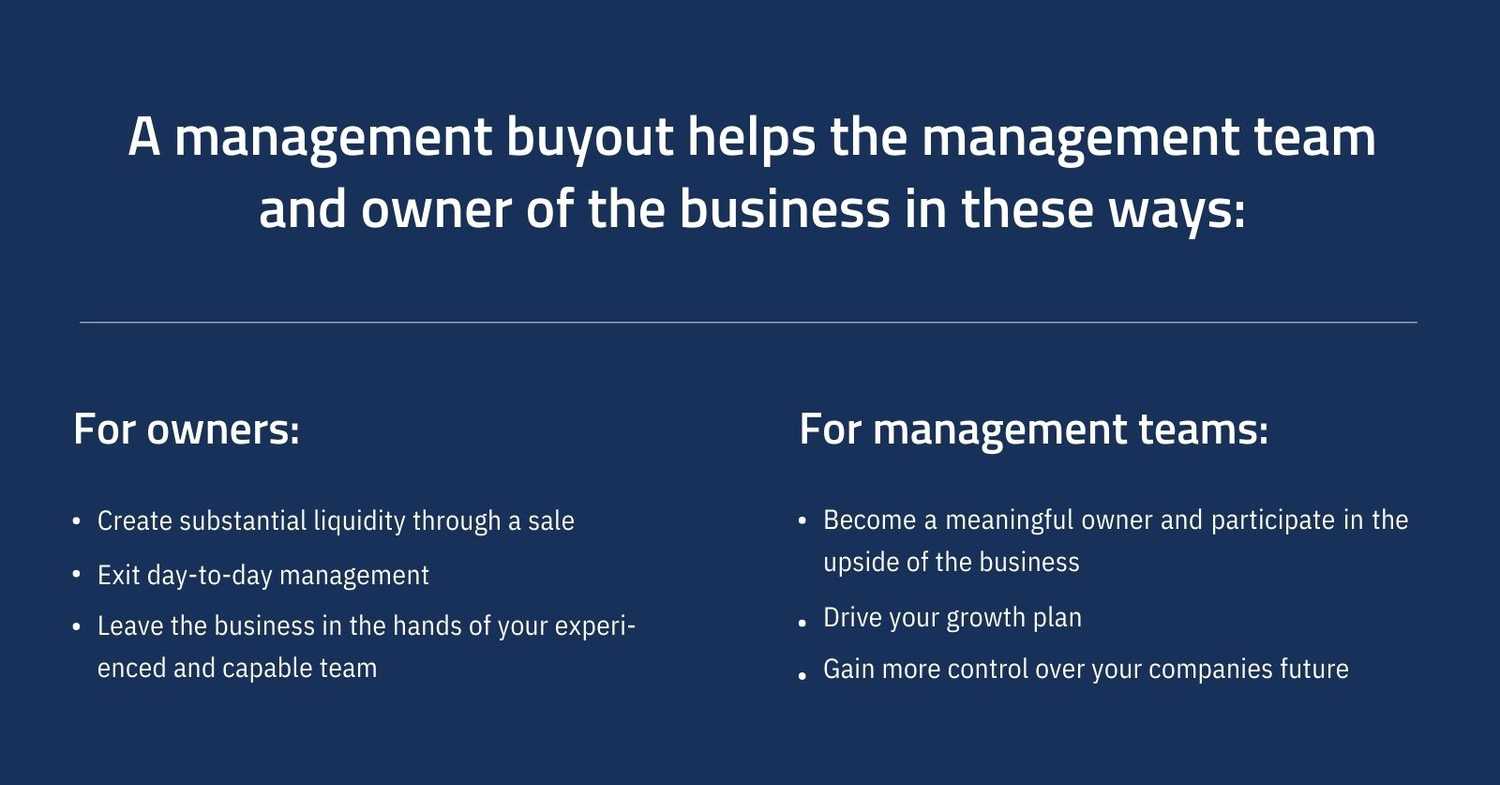

Benefits to Owners and Management Teams

As mentioned earlier, the underlying motivation for parties involved in a buyout is generating value. Value can have different meanings to management and ownership, so we’ve outlined the specific benefits of a management buyout.

For Owners:

- A management buyout creates substantial liquidity through a sale. Owners typically expect to receive significant cash at the closing of a management buyout.

- Owners can phase themselves out of day-to-day operations as management transitions into a dual management/ownership role. The former owner then has the option to fill an “advisor” role, acting as a resource to management.

- Existing management already possesses the expertise and dedication to run the business, which allows selling owners to be confident in the continuation of their legacy through the work of a capable successor team.

For Management Teams:

- Managers can become meaningful owners and participate in the upside of their business. The management team can now put in place their desired strategies to pursue additional growth and can benefit from their continued success.

- As management transitions into ownership, their responsibilities increase, and they fill a larger leadership role in the company. This can be empowering and allow management to further drive the company to reach its long-term vision.

- Management receives control over both the companies and their own future. The ability to determine the future of their professional career and the feeling of control within a business is an intangible benefit new ownership receives.

Management Buyout Options: Finding the Right Fit

There are several forms of an MBO: leveraged management buyout, phased management buyouts, management buy-ins, and employee stock ownership plans.

Leveraged Management Buyout

Most management buyouts are completed using debt financing, also commonly called “leverage” – hence the name “leveraged management buyout.” In a leveraged management buyout, management raises capital in the form of equity and debt financing to acquire the company. The equity may be raised from management’s own savings, friends and family, or third-party equity sources like private equity firms.

Debt capital is raised from commercial lenders, and company assets are used as collateral to secure debt financing. Seller notes are also commonly used to finance a portion of the acquisition price. In a leveraged management buyout, it is most common for the management team to acquire a significant majority equity position in the target company.

Phased Management Buyouts

Alternatively, some management buyouts are done over a longer horizon. Management may receive a small equity position from the existing owner with the right to acquire additional equity ownership over time at a fixed valuation or a valuation tied to relevant business performance metrics. This form of long-term succession ensures the capability of management to eventually fill an ownership role. Additionally, if future ownership is tied to business performance, it may motivate management to work in the business's best interest and increase value for both parties. Long-horizon successions can be useful in certain situations, but they require the time and effort of current ownership to ensure its success.

Management Buy-In

During a management buy-in, an external management team acquires the business and supplements and can replace or maintain the current team. Management buy-ins are commonly done with the help of a private equity firm. The private equity firm provides the bulk of the capital to complete the acquisition and installs a management team they are familiar with to run the company.

Given the risk that new, external management does not have the expertise to run the company as planned, a management buy-in is sometimes considered disadvantageous when compared to a traditional management buyout where the existing team continues to run the company after a sale.

Employee Stock Ownership Plans

Employee Stock Ownership Plans (“ESOPs”) involves an owner selling their company to its employees. ESOPs are retirement plans that use borrowed money and funds from existing employee’s retirement plans to fund the “purchase” of the business from the owner. ESOPs provide great tax benefits and use share value as an incentive for employees to ensure they work in the company's best interest. However, ESOPs are extremely complex to set up and administer and may be a less appealing choice when compared to a simpler and faster management buyout.

Given the wide variety of choices available, it is important for both management and ownership to understand the rationale behind each option. Traditional management buyouts and leveraged buyouts have the advantage of speed and reliability, but there are downsides they can present as well. Since management is the decided purchaser from the onset of the transaction, ownership loses the benefit of marketing to a large buyer pool and the potential for a higher valuation. For the management team, acquiring the business, you operate from the existing owner can present challenges in negotiating valuation and key transaction terms as well as sourcing the capital required to fund the transaction.

Parties Involved in a Management Buyout

Looking closer at the individuals involved in a management buyout, there are five identifiable key players: the seller, the buyer, the lender, the source of equity, and the service providers.

Seller:

The seller is the current owner of the business who is attempting to exit - immediately or over time. The seller may be active in the day-to-day operations or be a passive, inactive owner.

Buyer:

The buyer is the manager(s) that is currently operating the business and is seeking to replace the current owner either in part or in full.

Lender:

Debt financing for the purchase of a business can come from several different lending sources. Commercial lenders are the most frequently used source. However, alternatives exist, such as a seller note, which allows a business with limited debt capacity to secure funding for the transaction through the repayment of debt to the seller or owner.

Equity:

Equity can come from many different sources to help fund an acquisition. Management, private equity firms, and even individual investors can serve as viable sources of equity financing in a management buyout.

Service Providers:

Service providers include accountants, attorneys, and additional consultants that ensure the legitimacy of records, provide market research, and help form documentation to finalize the buyout.

Important Considerations, Common Challenges, & Potential Pitfalls

Most difficulties during a management buyout happen due to conflicting expectations or inaccurate information. Having productive conversations between management and ownership to align goals before undergoing a management buyout is a great preventative act. While there are many considerations in a management buyout process, there are a handful of significant issues that often need to be addressed to achieve a successful outcome for both parties:

- Valuation

- Due Diligence

- Transaction Structure

- Go-Forward Roles

The valuation of the target company is often the first consideration that must be addressed between the buyer (management team) and the seller (existing owner). This process can be tricky as valuation is often a zero-sum game. Establishing an agreed-upon valuation can be done with or without the use of third-party advisors like M&A advisors or business valuation firms.

Advanced preparation for the due diligence process can save time and effort to achieve a satisfactory outcome for all parties. The target company in a management buyout must be able to articulate both financial and key business information to lenders and other financing sources thoroughly. This due diligence process can be difficult for businesses with poor record-keeping practices, as investors will want assurance of past performance and any additional claims made by ownership. Fortunately, in a management buyout, management’s existing knowledge of the business can lessen the burden of due diligence when compared to selling a company to an outside buyer.

The appropriate capital structure (mix of debt and equity) to fund the transaction must also be determined to ensure the viability of the business after the transaction closes. Finding the optimal breakdown of funding helps ensure that the capital structure of the business is sound and provides appropriate operating flexibility and liquidity. Management should be realistic about how much equity and debt they can source when purchasing a business. Bringing in an equity partner may seem unappealing to managers who hope to gain full control of the business, but exposing the company to risk associated with increased debt can also prove to be detrimental. Factoring in the effects of funding on capital structure will ensure the business remains viable after closing the transaction.

Go-forward roles of management and former owners are often an area of potential friction in management buyouts. Former owners may stay too involved in the business after closing, which can be frustrating to incoming ownership. In addition, former owners could also remove themselves entirely from daily operations, which could leave incoming owners clueless about important parts of the business operation. Specific details outlining the involvement of both management and former ownership should be created to eliminate any conflict after the transaction.

Private Equity and its Role in Management Buyouts

Private equity firms can be valuable partners to management teams seeking to complete a management buyout. Private equity firms provide relevant transaction experience, a ready source of capital, relationships with debt sources, and resources and support for management after a transaction closes.

However, it is important to research the focus of the private equity firm before incorporating them into the transaction. Creating alignment around expectations, future goals, and business values are critical to a successful partnership.

Bluff Manufacturing – Management Buyouts at Hadley

Bluff Manufacturing manufactures and sells heavy-duty steel and aluminum dock boards and plates, portable yard ramps, and other warehouse safety equipment to companies throughout North America. Bluff’s longstanding commitment to the highest quality and outstanding customer service has helped to sell its dock solutions products to companies both large and small.

How Hadley Helped

Clark Smith grew Bluff Manufacturing from a small metal fabrication shop into a leading, branded manufacturer of heavy-duty material handling equipment. Hadley met Clark in 2011 when he was looking for a partner to help him complete a management buyout from an inactive owner.

Clark was eager to gain an experienced partner to help him transition leadership of the business and to support his team’s growth strategy. Following the management buyout, Hadley and Clark promoted Andrea Curreri from Vice President to President while Clark continued to serve as a mentor and board member.

Andrea moved quickly, implementing numerous growth and improvement plans with Hadley’s support. Bluff added financial systems and staff, invested heavily in new marketing initiatives, introduced numerous new products, recruited additional managers, developed new channel partners, and added stocking warehouses throughout the United States.

Bluff’s sales and profitability grew substantially during Hadley’s ownership and under Andrea’s leadership, and in 2016 we sold the business to Wincove Private Holdings, a larger private equity firm. Wincove and Bluff then bought two other companies, Westco and Nordock, and combined these three entities under a new umbrella company named Integrated Warehouse Solutions.

In Conclusion

Conducting a management buyout can be daunting, but a successful transaction can often meet the needs of all stakeholders and create a unique win/win outcome. Hadley has worked with a number of management teams and owners on successful management buyouts. Are you looking to explore options for selling your business via a management buyout? Are you a manager looking to buy a business that you operate? Contact Hadley today to discuss how we can be helpful.